Free Reasons For Picking An RSI Divergence Strategy

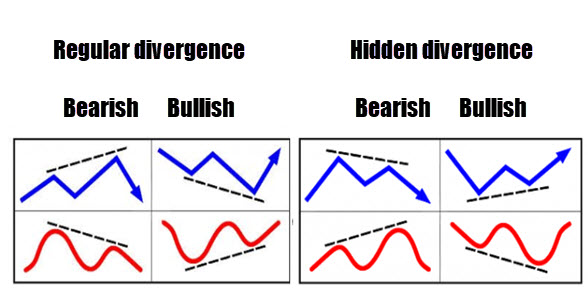

Great Facts For Picking An RSI Divergence StrategyOkay, let's begin by asking the obvious query and find out what RSI Divergence is and what trading clues we can get from it. When the price action and RSI indicators aren't in sync, a divergence can be seen in the chart. The RSI indicator may make lower lows when in an uptrend, however the price action is able to make lower lows. A divergence happens the case when an indicator isn't in agreement with the price action. This is an indication that you must pay close attention to the market. The chart clearly displays both bullish RSI divignance as well as bearish RSI divigence. This is why the price action reversed immediately following every RSI divergence signal. Let's dive into the exciting topic. Take a look at most popular trading platform for website examples including trading platform, automated trading software, forex backtester, automated crypto trading, RSI divergence cheat sheet, backtester, automated trading, cryptocurrency trading, automated trading bot, forex backtester and more.

What Is The Best Way To Analyze The Rsi Divergence

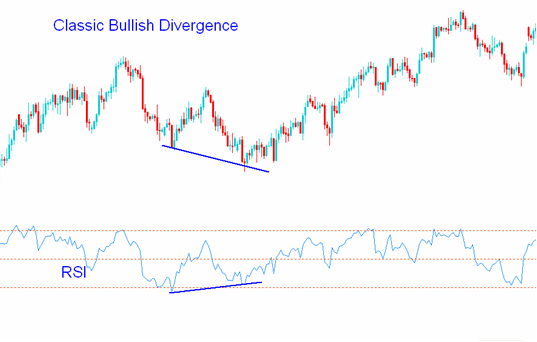

We utilize the RSI indicator to identify trends that are reversing. It is important to recognize the proper trend reverse. In the beginning, we must have an uptrending market. We then employ RSI divergence for weakness. After that information has been identified it is then possible to make use of it to determine the trend reverse.

How Do You Spot Rsi Divergence In Trading In Forex

Both Price Action indicator and RSI indicator have reached higher highs in the initial uptrend. This usually indicates that the trend is robust. At the conclusion of the trend, Price forms higher highs but the RSI indicator formed lower highs, which indicates that there is something worth watching in this chart. This is why we need to pay attention to the market. The indicators and price actions are not in sync and could be a sign of an RSI divergence. The RSI divergence in this instance indicates a bearish trend rotation. Have a look at the graph above and note what transpired following the RSI divergence. The RSI Divergence is very precise in identifying trends reversals. The question now is how do you spot the trend reversal. Let's examine four strategies for trading that mix RSI divergence and higher-probability signals. Read the top backtesting platform for website advice including divergence trading forex, forex backtest software, automated cryptocurrency trading, forex backtesting, software for automated trading, crypto trading bot, cryptocurrency trading bot, crypto backtesting, forex trading, position sizing calculator and more.

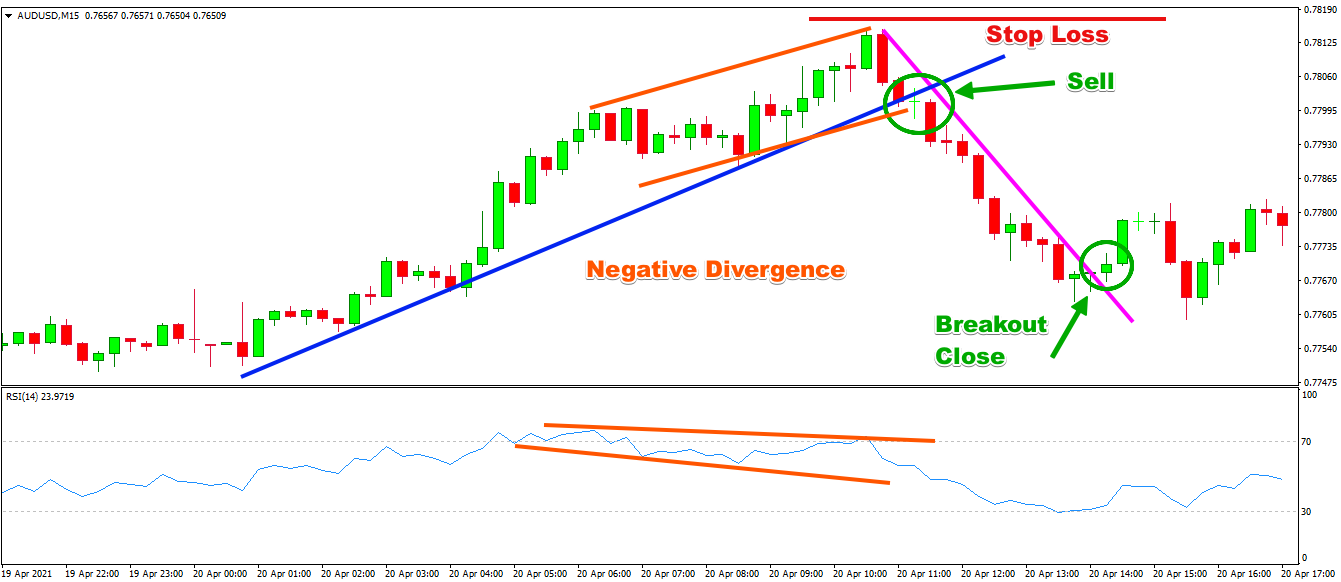

Tip #1 – Combining RSI Divergence & Triangle Pattern

There are two kinds of chart pattern that are triangles. One is the ascending Triangle pattern, which works in an uptrend as reverse patterns. The pattern of the descending triangle functions as an uptrend market pattern that reverses. Take a look below at the pattern of descending triangular as depicted on the chart of forex. The market was in an uptrend, and it eventually began to decrease. RSI may also be a sign of divergence. These signals can be a sign of the declines of this uptrend. We can now see that the current uptrend is slowing down. In the end, the price has formed the downward triangle. This is proof of the reverse. Now it's time for the short trade. Similar to the previous example, we used the same breakout strategies for this trade , too. We will now look at the third trade entry technique. This time , we're going to pair trend structure with RSI divergence. We will now look at ways to trade RSI diversion in the event that the structure of the trend is changing. Have a look at the best forex tester for site tips including best forex trading platform, trading platform cryptocurrency, crypto trading backtesting, forex backtesting, RSI divergence cheat sheet, cryptocurrency trading bot, forex tester, backtesting tool, RSI divergence, crypto trading bot and more.

Tip #2 – Combining RSI Divergence with the Head and Shoulders Pattern

RSI divergence aids forex traders to identify market reversals, right? Combining RSI divergence along with other indicators of reversal like the Head and Shoulders patterns will increase the probability of trading. That's great! Now let's see how to make our trades more profitable by combing RSI divergence with the head and shoulders pattern. Related: Trading Head and Shoulders Patterns in Forex: A Reversal Trading strategy. An enviable market conditions are required before you can trade. If we want to see a trend change then it is best to be in a good market. Below is the chart. Read the best online trading platform for more recommendations including crypto trading backtester, crypto backtesting, forex backtesting software, crypto trading bot, backtesting, automated crypto trading, crypto trading backtesting, cryptocurrency trading bot, backtesting platform, best crypto trading platform and more.

Tip #3 – Combining RSI Divergence With the Trend Structure

The trend is our best friend. The trend is our friend, as long that it's trending. We need to trade in the direction of its movement. This is what professionals teach. The trend won't last for long. It is bound to reverse at some point. So let's try to find those reversals in the early by observing trend structure and the RSI Divergence. We know that the uptrend is making higher highs and the downtrend is creating lower lows. Now with that in mind take a look at the chart below. On the left hand side of the chart you'll see a downtrend. There are many of lows, and then lower highs. Next, you can see the RSI deviation (Red Line). The RSI creates high lows. Price action creates lows. What do these numbers tell us? Despite the market generating low RSI This means that the current downtrend is losing its momentum. Check out the top best trading platform for blog advice including automated trading platform, trading platform cryptocurrency, cryptocurrency trading, automated trading, automated trading software, bot for crypto trading, automated crypto trading, forex backtester, crypto trading backtesting, forex backtesting software and more.

Tip #4 – Combining Rsi Divergence And The Double Top/Double Bottom

Double top or double bottom is a reversal pattern that is formed after a long-term move or following an established trend. Double tops are formed when the first top will be formed when the price reaches the level at which it cannot be broken. The price then reverses only a little, before returning to the level it was at. If the price bounces back from the level, you'll see a double top. Have a look at the double top. In the double top above, you can see that two tops were formed after a strong move. The second one was unable to surpass its predecessor. This is a strong indication that the buyers are struggling to go higher. The same principles apply to the double bottom, however, it's done in reverse. We utilize the technique of entering trades using breakouts. This is the place we employ the breakout entry technique. We sell when the price is below our trigger. We recouped our profits after the price fell to below the trigger line. QUICK PROFIT. Double bottom requires the same strategies for trading. The chart below to learn the best way to trade RSI divergence when there's a double bottom.

This isn't the ideal trading strategy. There isn't a "perfect" trading strategy. Each trading strategy has losses. Profits are consistent from this trading strategy BUT we're using a tight risk management and a method to minimize our losses swiftly. We can cut down on our drawdown while also opening up new opportunities for great upside potential.